Biocon Biologics Ltd (BBL) has ended financial year 2023 (FY23) on a high. The year marks an inflection point in its value creation journey as the acquisition of partner Viatris’ biosimilars business has catapulted the company into the global big league.

BBL more than doubled its revenue on a YoY basis to Rs 2,102 crore in Q4FY23, which marks the first full quarter of consolidation of financial numbers from its base business and the acquired business. This indicates a USD 1 billion annual revenue trajectory for BBL.

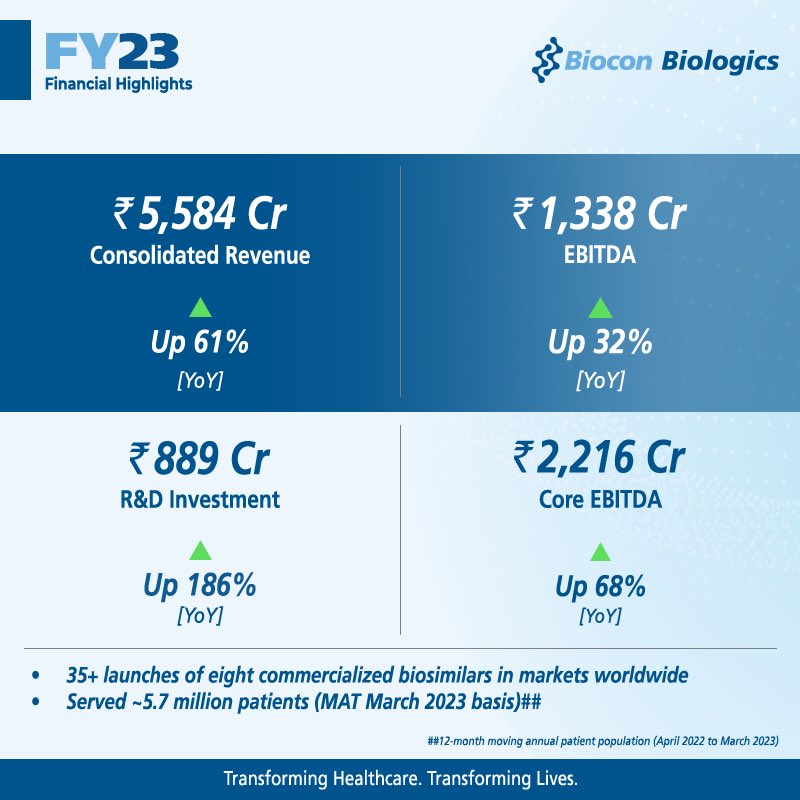

For the full year FY23, it reported revenues of Rs 5,584 crore, a 61% increase from last year.

BBL reported healthy profitability despite a steep jump in its R&D investments, which reflect the progress of its pipeline assets in global clinical trials.

EBITDA for the quarter increased 123% to Rs 573 crore, representing healthy EBITDA margins of 27%. EBITDA for the year stood at Rs 1,338 crore, a year-on-year growth of 32%.

Expanding Access to Biosimilars Globally

In addition to delivering a robust financial performance, Biocon Biologics successfully enhanced patient access to its high quality biosimilars worldwide during the year. There were over 35 launches in global markets during the year.

Advanced Markets

The Advanced Markets contribute to 70% of BBL’s global biosimilars sales, while emerging markets contribute 30%.

The acquisition of Viatris’ global biosimilars business has given Biocon Biologics the opportunity to have a direct presence in the advanced markets of U.S., Canada, EU, Australia and New Zealand.

Biocon Biologics is having productive discussions with key customers in the U.S. in preparation for the upcoming integration of the Viatris biosimilars business and the launch of new products in the market.

In Europe, the company is evaluating expansion in key countries as it transitions the Viatris business.

It is also steadily progressing in exploring additional growth initiatives in other key clusters to expand reach where Viatris was not currently participating.

BBL’s commercialized biosimilars continued to perform well in the Advanced Markets.

In FY23, Semglee (bGlargine) and Fulphila (bPegfilgrastim) improved their market shares, which are currently at 12% and 14% respectively, while Ogivri (bTrastuzumab) maintained its position at 10% in the U.S.

Biosimilars such as Fulphila, Ogivri and Hulio (bAdalimumab) witnessed gradual improvement in their performance in Europe. Ogivri reported double-digit market shares in France and Italy, while Fulphila captured double-digit share in France.

Hulio maintained its market share at 18.5% in Germany and 10% in France.

Biosimilars commercialized in Canada also reported robust performance during the year with Ogivri capturing a 35% market share, currently. Hulio, which was recently launched in Canada, has already attained a market share of 6%.

As a fully integrated, global biosimilars player, BBL is optimally positioned for expansion and improving our penetration in the Advanced Markets. Its strategic alliances, exemplified by the collaborations for our U.S. oncology and diabetes franchises, will pave the way for growth in these markets.

Emerging Markets

The integration of the acquired Emerging Markets business from Viatris is on track. BBL plans to transition the business region-wise in a phased manner during FY24 with over 70 Emerging Markets transitioning to Biocon Biologics shortly.

Business performance in the Emerging Markets in FY23 was driven by continued strong demand for BBL’s biosimilar insulins and monoclonal antibodies, growing portfolio coverage and several new launches.

The Company expanded global reach through 8 new product launches in the AFMET, LATAM and APAC regions, which augurs well for the future. Q4FY23 also saw the launch of bAspart in Malaysia and bAdalimumab in two new countries.

New tenders for bTrastuzumab, bGlargine and bPegfilgrastim won in Q4FY23 in the AFMET and LATAM regions will contribute to growth in our Emerging Markets business in FY24.

Advancing Biosimilars Pipeline

BBL has built a sizeable pipeline of biosimilars that are at various stages of development. Its pipeline includes bUstekinumab for inflammatory conditions, bDenosumab to treat osteoporosis and cancer, bPertuzumab for breast cancer, bGlargine 300U for diabetes and seven other early-stage undisclosed programs. The pipeline also includes ‘first-to-file’ bAflibercept. BBL has acquired Viatris’ rights for this biosimilar that is used to treat wet macular degeneration, which is a long-lasting eye disorder that causes blurred vision or a blind spot in the central vision.

Three of these assets, namely bDenosumab, bUstekinumab and bPertuzumab, are progressing well in their ongoing clinicals trials.

BBL has a significant opportunity to make a meaningful impact on patients’ lives. In the next five years, the global opportunity for its biosimilars pipeline is expected to grow to USD 78 billion, providing BBL with sustainable growth in the years ahead.

Conclusion

FY23 has been an important inflection point in BBL’s transformational journey as it prepared for important launches in FY24 and started integrating the acquired business in a phased manner. There is a strong interest in the upcoming U.S. launch of Hulio, backed by its performance in Europe, which will be a key growth driver in FY24. Hulio is indicated for the treatment of a host of autoimmune diseases such as arthiritis, psoriasis, Crohn’s diseases and ulcerative colitis.

BBL’s strong business fundamentals and fully integrated global capabilities will allow the company to capitalize on market opportunities and expand its reach to patients globally, going beyond serving ~5.7 million patients annually.